CVB Financial Corp CVBF Stock Price, Quote & News

The Barchart Technical Opinion rating is a 32% Buy with a Average short term outlook on maintaining the current direction. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Plus, CVBF info will be updated daily in your Zacks.com Portfolio Tracker – also free. Compare

CVBF’s historical performance

against its industry peers and the overall market.

First BanCorp’s Meteoric Rise: Unpacking the 24% Surge in Just 3 … – GuruFocus.com

First BanCorp’s Meteoric Rise: Unpacking the 24% Surge in Just 3 ….

Posted: Fri, 01 Sep 2023 19:04:41 GMT [source]

The assets sold were from CVB’s biggest lending relationship with ran… CVB Financial’s stock was trading at $25.75 at the start of the year. Since then, CVBF shares have decreased by 32.3% and is now trading at $17.43. ONTARIO, Calif., Feb. 24, 2022 (GLOBE NEWSWIRE) — CVB Financial Corp. (“CVBF”), the holding company for Citizens Business Bank (“CBB”, and collectively with CVBF, the “Company”), announced that two o… Style is an investment factor that has a meaningful impact on investment risk and returns.

CVB Financial Corp. Announces 133rd Consecutive Cash Dividend

A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. CVB Financial says it’s received a subpoena from the Securities and Exchange Commission seeking information about how the California bank handles troubled loans. SAN FRANCISCO (MarketWatch) — CVB Financial Corp. slumped more than 20% in morning trading Tuesday after the California bank said it got a subpoena from the SEC. MarketWatch’s daily roundup of shares making notable moves in U.S. trading.

- Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

- Investors of record on Thursday, July 6th will be paid a dividend of $0.20 per share on Thursday, July 20th.

- Sign-up to receive the latest news and ratings for CVB Financial and its competitors with MarketBeat’s FREE daily newsletter.

- Plus, CVBF info will be updated daily in your Zacks.com Portfolio Tracker – also free.

We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. CVBF’s beta can be found in Trading Information at the top of this page.

DA Davidson Maintains Neutral Rating for CVB Financial: Here’s What You Need To Know

High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, 800 in gmat opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

CVB Financial Corp. operates as a bank holding company for Citizens Business Bank, a state-chartered bank that provides banking and financial services to small to mid-sized businesses and individuals. It offers checking, savings, money market, and time certificates of deposit products for business and personal accounts; and serves as a federal tax depository for business customers. Further, the company provides trust services, such as fiduciary services, mutual funds, annuities, 401(k) plans, and individual investment accounts. The company was founded in 1974 and is headquartered in Ontario, California.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year.

Price and EPS Surprise Chart

Style is calculated by combining value and growth scores, which are first individually calculated. Data are provided ‘as is’ for informational https://1investing.in/ purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

Earnings are growing at CVB Financial (NASDAQ:CVBF) but shareholders still don’t like its prospects – Yahoo Finance

Earnings are growing at CVB Financial (NASDAQ:CVBF) but shareholders still don’t like its prospects.

Posted: Mon, 26 Jun 2023 07:00:00 GMT [source]

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. U.S. financial stocks pare earlier losses after the Federal Reserve says it will reinvest proceeds from maturing mortgage debt back into the Treasury market. Get this delivered to your inbox, and more info about our products and services. One share of CVBF stock can currently be purchased for approximately $17.43. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation.

Barchart Technical Opinion

Its products include loans for commercial businesses, commercial real estate, multi-family, construction, land, dairy and livestock and agribusiness, consumer and government-guaranteed small business loans. The company was founded by George A. Borba on April 27, 1981 and is headquartered in Ontario, CA. 3 Wall Street research analysts have issued 12 month price targets for CVB Financial’s shares. On average, they anticipate the company’s stock price to reach $20.00 in the next twelve months.

That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

CVB Financial shares slide after the California bank says it has received a subpoena from the SEC seeking information about how the company handles troubled loans. SAN FRANCISCO (MarketWatch) — CVB Financial Corp. shares rose Monday after the California bank was upgraded to buy from hold by Hugh Miller, an analyst at Sidoti & Co. SAN FRANCISCO (MarketWatch) — CVB Financial shares jumped more than 10% Tuesday after the California bank said it sold troubled loans for $41 million.

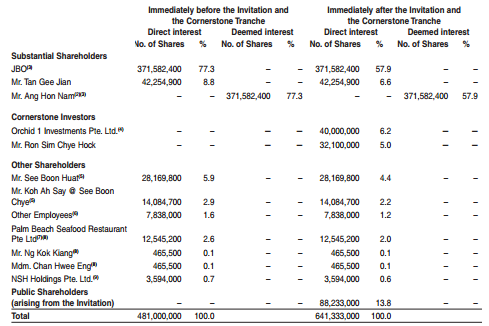

Company Ownership

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. CVB Financial Corp. is a bank holding company, which engages in the provision of relationship-based banking products, services, and solutions for small to mid-sized companies, real estate investors, non-profit organizations, professionals, and other individuals through…

Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion. SAN FRANCISCO (MarketWatch) — CVB Financial Corp. said in a late Thursday regulatory filing that Executive Vice President Todd Hollander resigned. Hollander joined CVB in May 2008 to run the bank’s sales division and ove…

Benzinga’s Top Ratings Upgrades, Downgrades For May 25, 2023

For example, a price above its moving average is generally considered an upward trend or a buy. CVB Financial declared a quarterly dividend on Wednesday, June 21st. Investors of record on Thursday, July 6th will be paid a dividend of $0.20 per share on Thursday, July 20th. This represents a $0.80 annualized dividend and a dividend yield of 4.59%. East West Bancorp (EWBC) saw its shares surge in the last session with trading volume being higher than average.

This suggests a possible upside of 14.7% from the stock’s current price. View analysts price targets for CVBF or view top-rated stocks among Wall Street analysts. 3 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for CVB Financial in the last twelve months. The consensus among Wall Street equities research analysts is that investors should “hold” CVBF shares. A hold rating indicates that analysts believe investors should maintain any existing positions they have in CVBF, but not buy additional shares or sell existing shares.